Market participants remain in limbo as tensions in the Middle East show no signs of slowing down. US President Trump urged Iranians to leave Tehran, claiming their government had refused a deal to limit nuclear weapons development.

This comes after G7 countries yesterday called for easing the worst conflict between the regional rivals, stating that Iran causes instability and must never have nuclear weapons, while supporting Israel’s right to self-defense.

This is sure to leave market participants in a state of confusion but judging by yesterday’s price action, markets have remained resilient thus far.

Asian Market Wrap

Asian stocks saw a slight rise, with gains in Japan and Taiwan, while markets in Hong Kong and China declined. Semiconductor stocks performed well as interest in artificial intelligence investments grew. On Wall Street, risk-taking returned, pushing the up about 1%, climbing back above 6,000.

Investors showed mixed confidence in the US economy. Longer-term Treasury bonds underperformed, even after a $13 billion sale of bonds met expected yields—an improvement from last month’s disappointing auction that triggered a market selloff. The dollar showed mixed performance against major currencies.

For more on the Asian session, read

Bank of Japan (BoJ) Adjusts Bond Tapering, Keeps Rates on Hold

As expected, the BOJ kept short-term at 0.5% after a two-day meeting. It also stuck to its current bond tapering plan, which reduces government bond purchases by 400 billion yen ($2.76 billion) per quarter, aiming to lower monthly purchases to 3 trillion yen by March 2026.

However, the BOJ announced a slower pace of reduction starting in fiscal 2026. From then, it will cut bond purchases by half the current rate, reducing monthly purchases to 2 trillion yen by March 2027. This adjustment matches requests from market participants during recent meetings.

BOJ Governor Kazuo Ueda said at a press briefing, “There is still a lot of uncertainty about trade policies in different countries, which increases risks for Japan’s economy and prices.”

Markets will be watching how Governor Ueda handles U.S. tariff risks and inflation in Japan to predict when the BOJ might raise interest rates again.

Source: LSEG

European Open

European stocks opened lower on Tuesday, with the dropping 0.8% to 542.38 points. This followed a small recovery on Monday after five days of losses.

Energy stocks performed the best, rising 0.3%, while all other sectors fell. Telecom companies saw the biggest drop, down 1.4%.

In individual stocks, London’s Ashtead (LON:) was one of the top gainers, even though it predicted slower growth in rental revenue.

On the FX front, the was little changed on Tuesday morning trading around the 98.16 handle and flat for the day. The , which is sensitive to risk, rose 0.13% to 0.6533 after an earlier drop. The also gained 0.1%, trading at 0.6065.

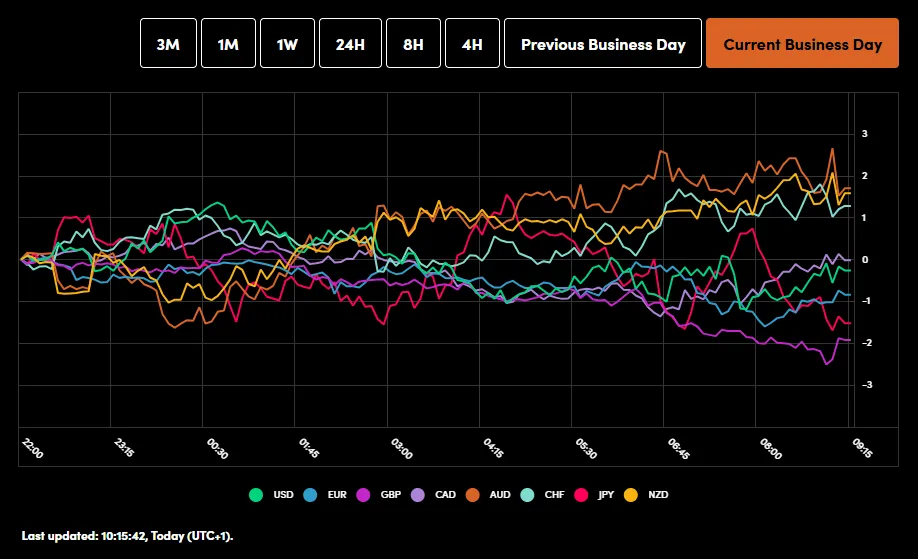

Currency Power Balance

Source: OANDA Labs

On the commodities front, peaked above the $3400/oz handle overnight before retreating to trade at $3384/oz at the time of writing. Gold has failed to build on last week’s rally despite the increasing tension in the Middle East. Quite a surprise given the initial reaction on Friday.

jumped on President Trump’s comments regarding Tehran residents and remains around 1.8% up on the day. Oil, like gold, took markets by surprise yesterday, finishing the day down 2.6%, but tensions in the Middle East should in theory keep oil prices elevated in the interim.

Economic Data Releases and Final Thoughts

Looking at the economic calendar, we have out in a bit which will be followed by US in the US session.

There are also a few speeches by ECB policymakers Villeroy and Centeno later in the day.

Tomorrow and Thursday bring a lot more high-impact data with both the US and Bank of England meetings.

For now, eyes will be focused on the Middle East. President Trump cut short his trip to the G7 meeting due to the situation in the Middle East. The president has requested that the National Security Council be prepared in the situation room.

This coupled with President Trump’s morning comments warning residents to leave Tehran, have sparked concerns that the US may ‘officially’ get involved in the conflict, which Tehran has warned would spark a wider conflict.

Chart of the Day – DAX Index

From a technical standpoint, the has failed to build on yesterday’s gains as it retests support around 23300.

The Index, like markets in general, is taking its cues largely from the fluid situation in the Middle East, which is keeping risk appetite in check for now.

It did appear that markets were going to shrug off the Middle East tensions, but developments over the last 24 hours have likely changed the narrative.

The DAX remains bullish without a daily candle close below the support area, which ends around the 23200 handle.

A candle close below this handle could open up further downside potential with the 50 and 100-day MAs likely coming into play at 22994 and 22716, respectively.

If a move higher materializes, resistance may be found at 23600 before the 23754 and 24000 handles come into focus.

DAX Daily Chart, June 17. 2025

Source: TradingView.com