RxSight Inc. RXST plummeted by 34.32% in after-hours trading on Tuesday. The drop followed the company’s decision to revise its 2025 revenue forecast.

What Happened: The stock of RxSight Inc. experienced a sharp decline in after-hours trading, closing at $8.40, a 34.32% decrease from the day’s closing price of $12.79. This sudden drop was a result of the company’s revised 2025 revenue guidance.

See Also: Cannabis Real Estate? Meet Green Life Business’ Drew Mathews, He Knows All About It – Benzinga

RxSight Inc. had initially projected its 2025 revenue to be in the range of $160 million to $175 million. However, the company recently adjusted this forecast to a much lower range of $120 million to $130 million.

Why It Matters: The recent drop in RxSight Inc.’s stock value is a direct consequence of the company’s revised revenue forecast. This development comes on the heels of the company’s preliminary second-quarter revenue announcement, which was $33.6 million, a 4% decrease year-over-year. This decline in revenue, coupled with the revised 2025 forecast, has impacted investor sentiment.

Despite the recent downturn, it is worth noting that RxSight Inc.’s stock had been performing well earlier in the year. In May, the company’s stock value rose after Wells Fargo upgraded its rating from Equal-Weight to Overweight, and raised its price target from $17 to $25.

Price Action: At the time of writing, RxSight Inc. experienced a decline in after-hours trading, plummeting 34.32% to $8.40 after closing at $12.79 – Benzinga Pro Data.

Benzinga’s Edge Rankings highlights a strong value score of 66.98 for RXST stocks. Know the other parameters on which the stock fares.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

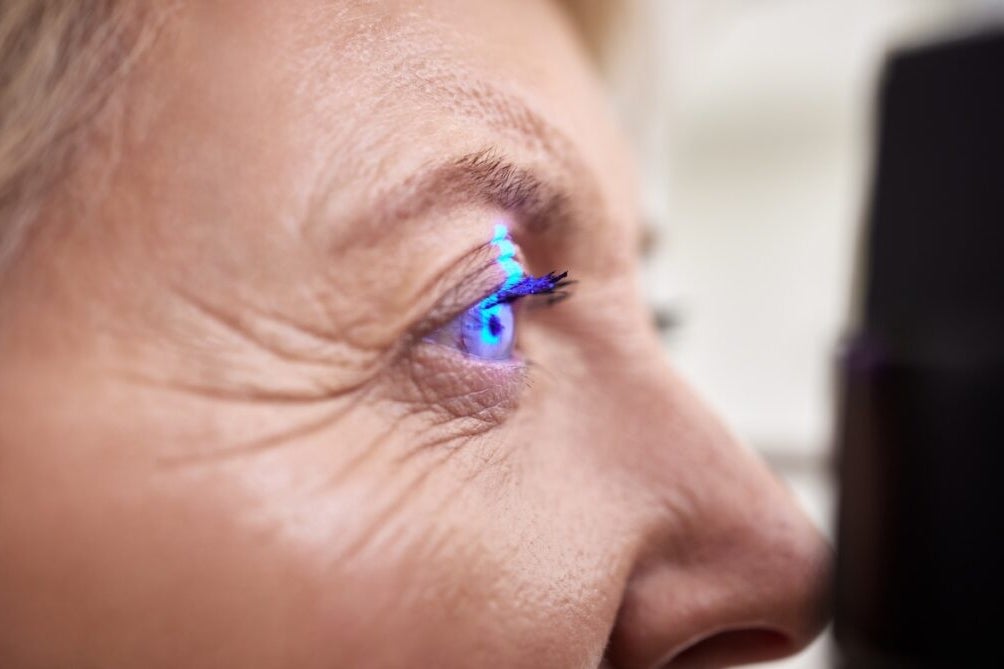

Photo Courtesy: PeopleImages.com – Yuri A on Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.