This analysis was conducted in cooperation with Anastasia Volkova- analyst (LSE).

market signals remain mixed. Summer 2025 contracts held just above their median pre-expiry levels last week, staying within historical volatility ranges. In contrast, winter 2026-27 contracts remained firmly above the upper bounds of the 10-day pre-expiry band, reflecting persistent supply and weather-related risk. The forward curve, though flatter in the 3-year segment, remains notably distorted in both short and long tenors versus 2020-2024 benchmarks – a sign of lingering structural uncertainty.

Meanwhile, fundamentals are stabilizing: storage injections rebounded to +63 BCF, inventories rose above the 5-year median, and NOAA forecasts point to weather normalization by late July. Still, the supply-demand balance remains below historical norms, suggesting short-term calm is masking longer-term imbalances.

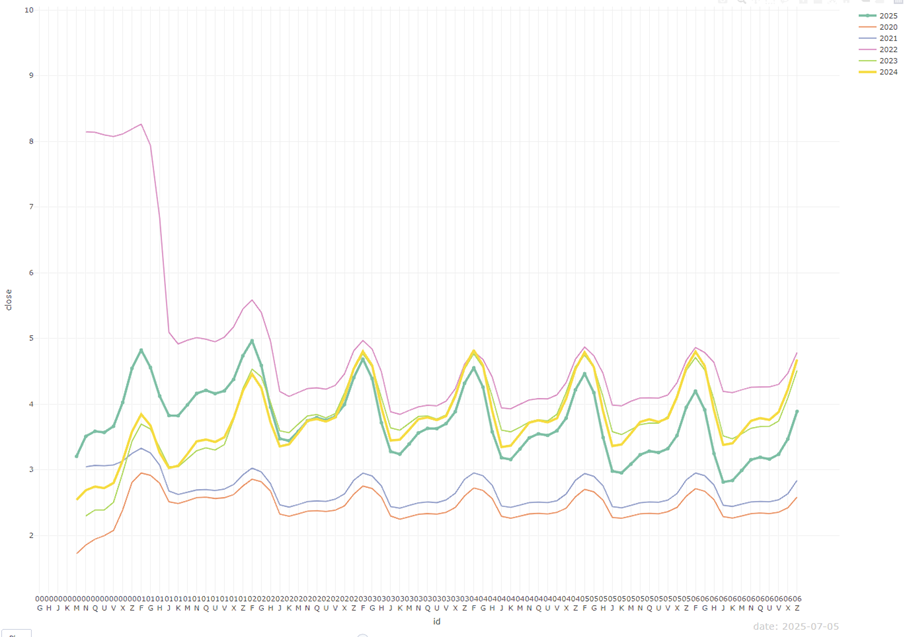

Current Prices Compared to Price Dispersion 10 Days Before Expiration by Month Since 2010

The price situation has remained virtually unchanged compared to last week. Summer 2025 contracts are trading a little bit above the median price at expiration, but remain within the interquartile range. Winter 2026 and 2027 contracts remain above the upper range. We expect prices to stabilize.

Forward Curve Compared to 2020-2024

Despite the fact that 2025 contracts with delivery in three years’ time are close to the prices of 2023 and 2024 contracts with corresponding delivery terms, there remains a strong skew in the forward curve for near-term deliveries (1-2 years) and long-term deliveries (5-6 years).

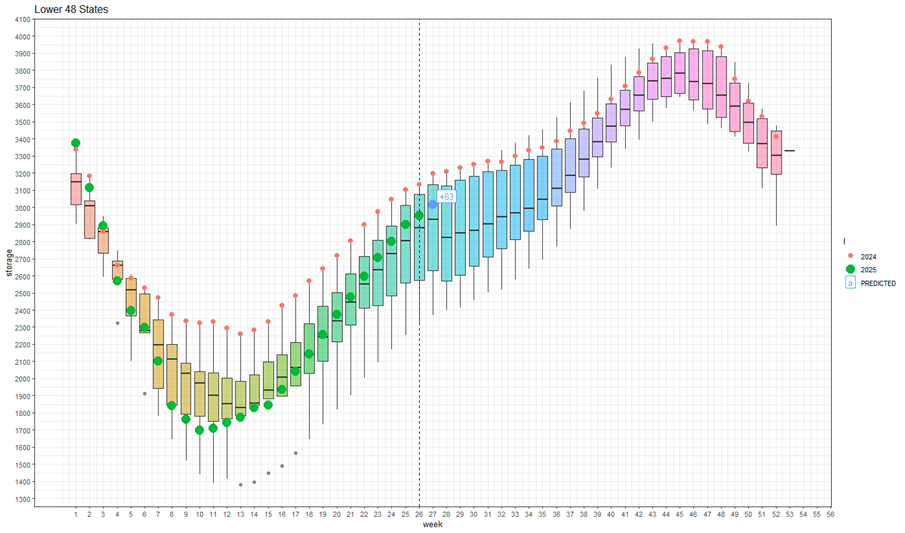

Current Stocks and Forecast For Next Week Compared to 2019-2024

For week 27 (June 28 – July 3), we expect an increase in storage of 63 BCF. The fill rate is above the median for the previous five years. Injection rates have recovered after last week’s decline, and if the current supply and demand conditions remain unchanged, peak levels for 2024 are possible. Weather and seasonal phenomena in the second half of summer remain a limiting factor.

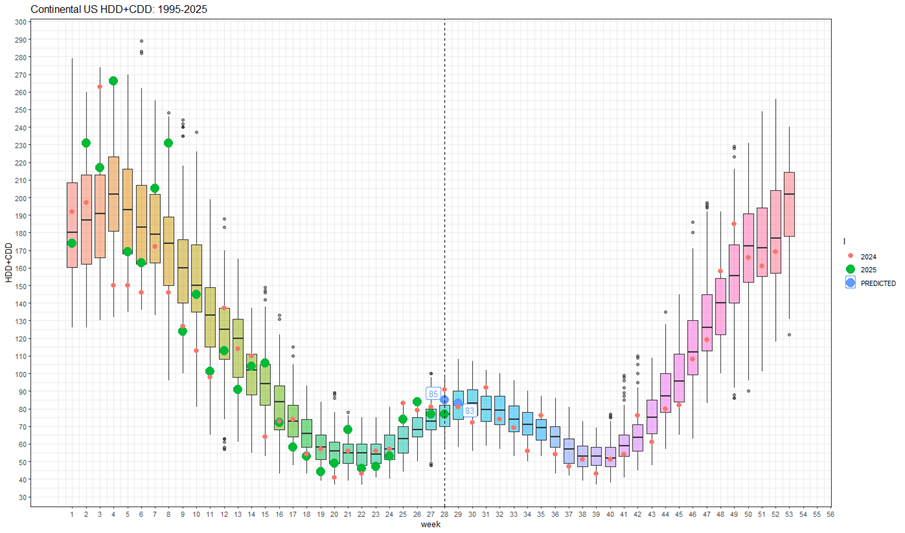

Weekly HDD+CDD Total Based on Current NOAA Data and Forecast for the Next Two Weeks Compared to 1994-2024

The weather is gradually stabilizing. Week 28 is expected to still be hot compared to the last 30 years, but on July 29, forecasts are reaching the median.

Explanation of the graph: the candles represent quantiles for 30 years from 1994 to 2024. Red dots are for 2024, green dots are for 2025, and blue dots are predictions for 2025.

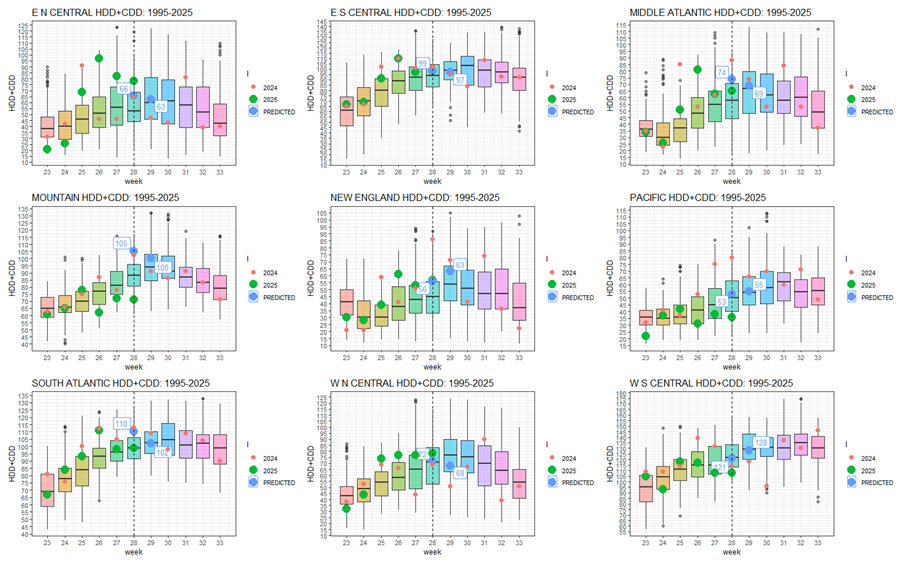

Weekly HDD+CDD Total Based On Current NOAA Data and Forecast for the Next Two Weeks Compared to 1994-2024 by Region

If we look at the situation by region, we see a similar stabilization of weather conditions in virtually all regions.

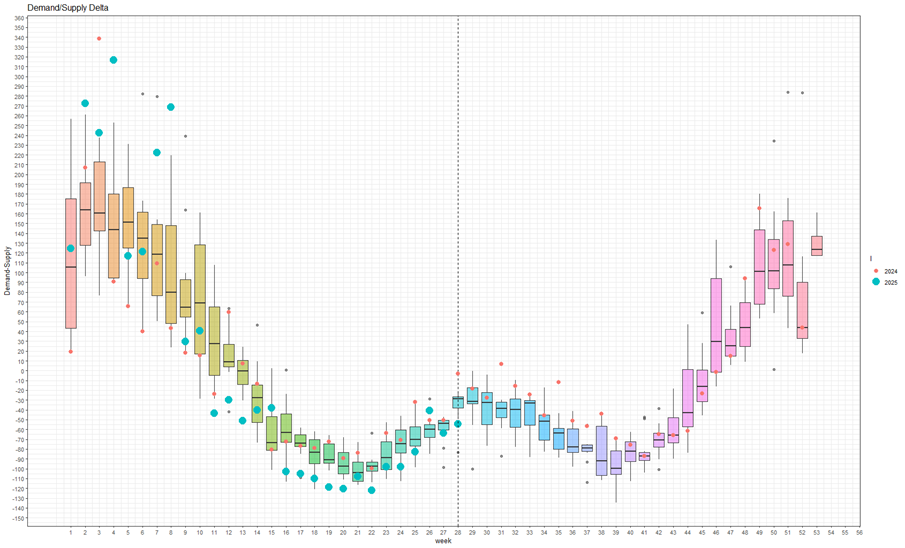

Weekly Total Difference Between Supply and Demand Compared to 2014-2024

The contributing factors of the supply-demand difference still do not allow it to approach the median. In the current Week 28, the balance remains well below historical levels.

Afterword

While near-term fundamentals are regaining balance, the broader pricing structure continues to reflect deeper unease. The divergence along the forward curve suggests the market is still pricing in systemic risks, whether from policy shifts, infrastructure uncertainty, or long-term demand volatility.

Regional weather normalization and storage growth offer short-term relief, but they haven’t yet translated into a restored supply-demand equilibrium. For now, sentiment appears cautiously neutral: anchored by recent injections, yet shadowed by unresolved structural signals farther out on the curve.