Stocks finished higher, but yesterday’s gains were more balanced, with both the equal-weighted and market-cap-weighted indexes rising.

Meanwhile, rates and the fell sharply following a week of rising .

If we’re entering a period when the is likely to rise, one would naturally expect the yield curve to steepen. The Treasury spread has been stuck around 50 basis points for a considerable time, but it now appears to be only a matter of time before that steepening resumes.

The broke down yesterday as well, and now I’m wondering if it’s going to undercut its recent lows around 3.5%. I’m not exactly sure what would need to happen for the 5-year yield to decline that significantly.

Meanwhile, the dollar continued to weaken, falling below support at 97.60 and closing beneath that level, setting up a potential move down to 95.50.

Volume yesterday in was slightly better than yesterday, though that’s not saying much—overall levels remain weak. At this point, I have no strong view on the stock market; it seems stuck in the land of the absurd. Volatility is highly compressed, even with significant economic data next week and potential trade “deals” due on July 9.

The market currently refuses to believe anything regarding tariffs, and why would it?

That’s precisely the risk right now, because if tariffs actually go into effect on July 9, especially sector-specific ones, or worse, the economic data does turn sour, equity markets are completely positioned offside.

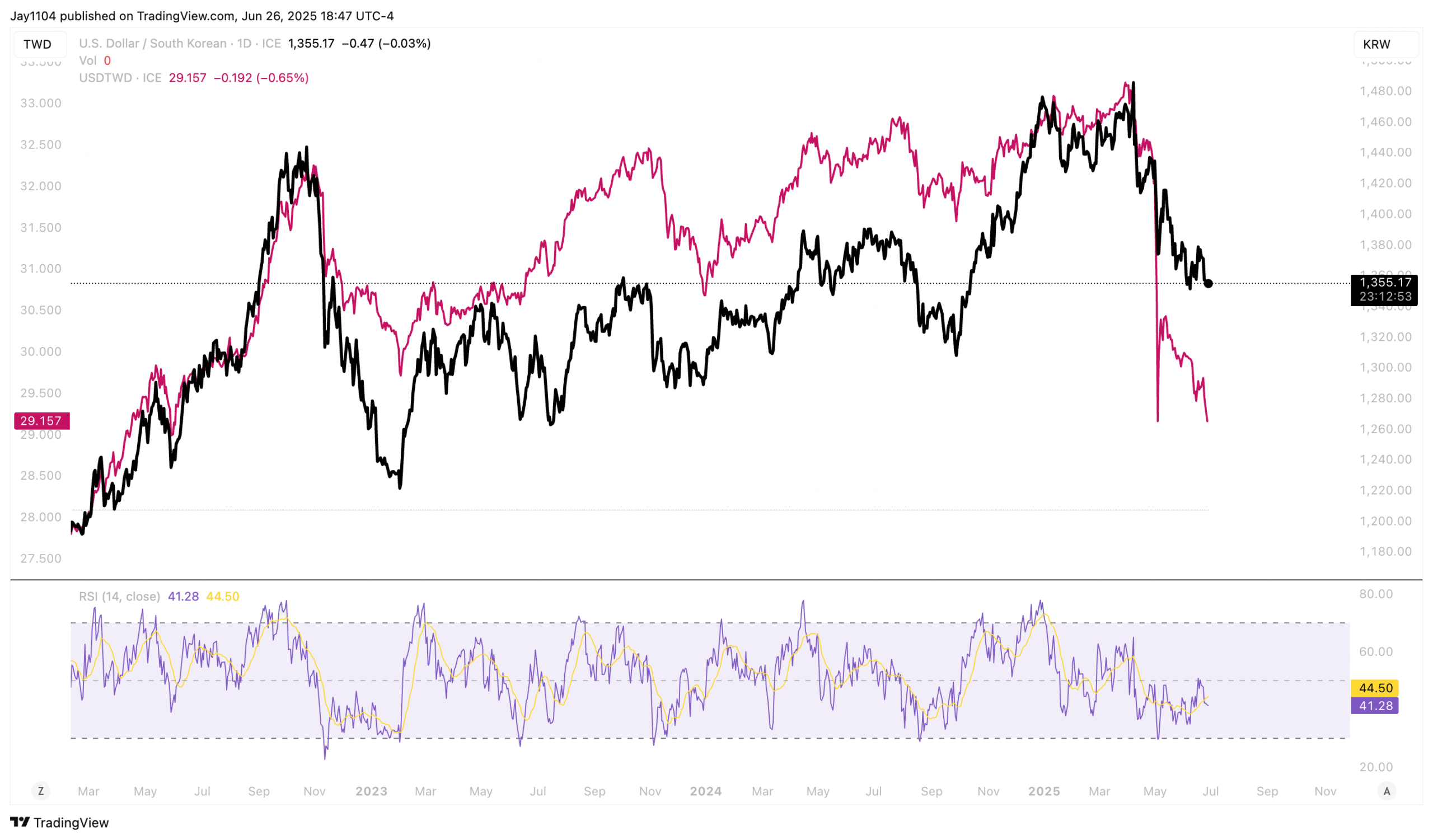

The FX market appears to be signaling that tariffs are indeed coming, as indicated by the dollar’s decline since the initial news broke in April. The most pronounced currency moves continue to be seen in regions like and .

Even high-yield spreads haven’t fully recovered their recent widening, reflecting an ongoing level of market concern.

That’s why the (RSP) hasn’t meaningfully advanced beyond its mid-February highs.