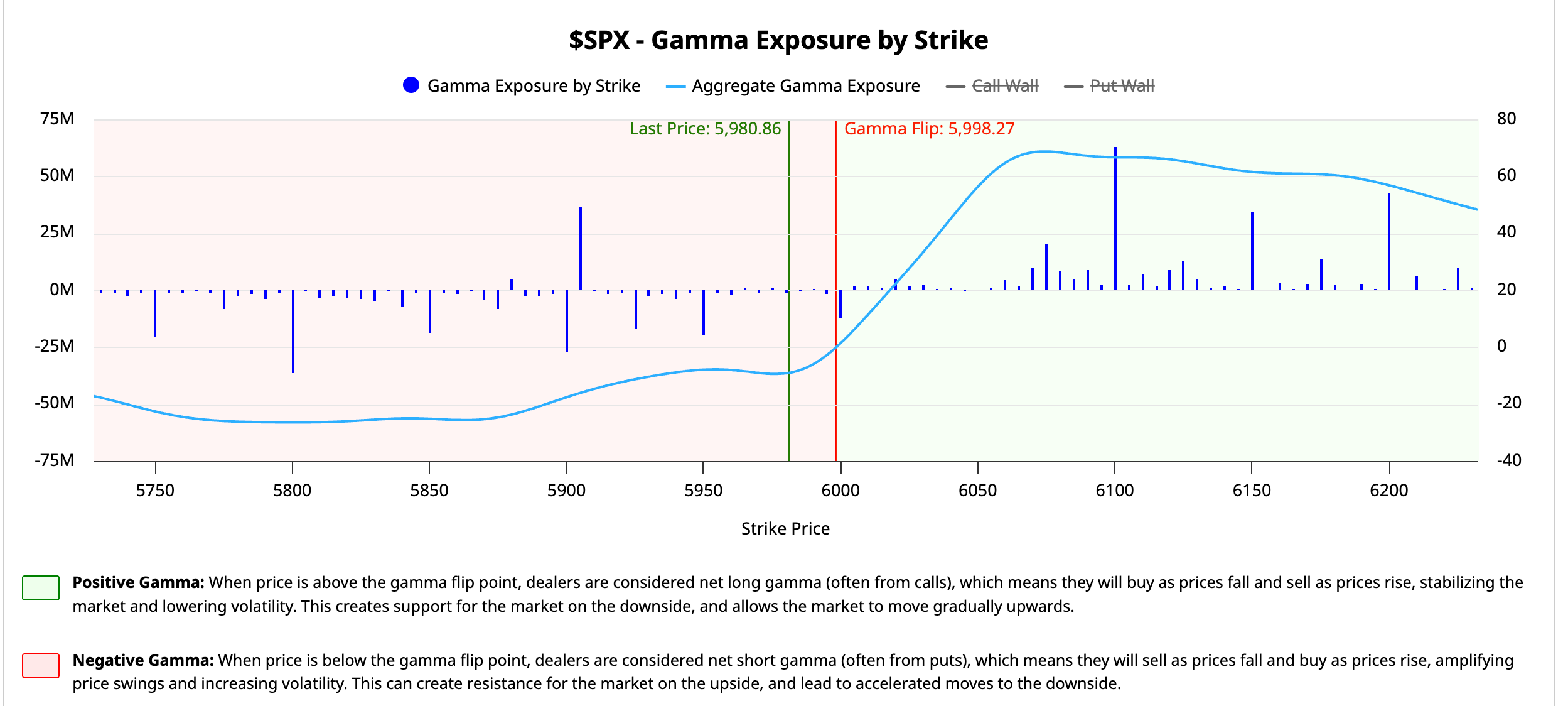

Stocks finished Wednesday flat, surrendering earlier gains ahead of the Federal Open Market Committee (FOMC) . A day earlier, I mentioned that an ideal scenario would have been a drop in the below 5,965. While we didn’t achieve that yesterday, nothing occurred to invalidate expectations for further downside. Friday now becomes pivotal, especially given option expiration and the current index positioning. Notably, we also closed below the 10-day EMA for the third time in four days.

It’s worth noting that once we move past Friday, support levels due to gamma positioning in the S&P 500 will drop toward 5,905, coinciding with the JPM Collar’s position. Given this alignment, that area could act as a magnet for the index next week.

(BARCHARTS)

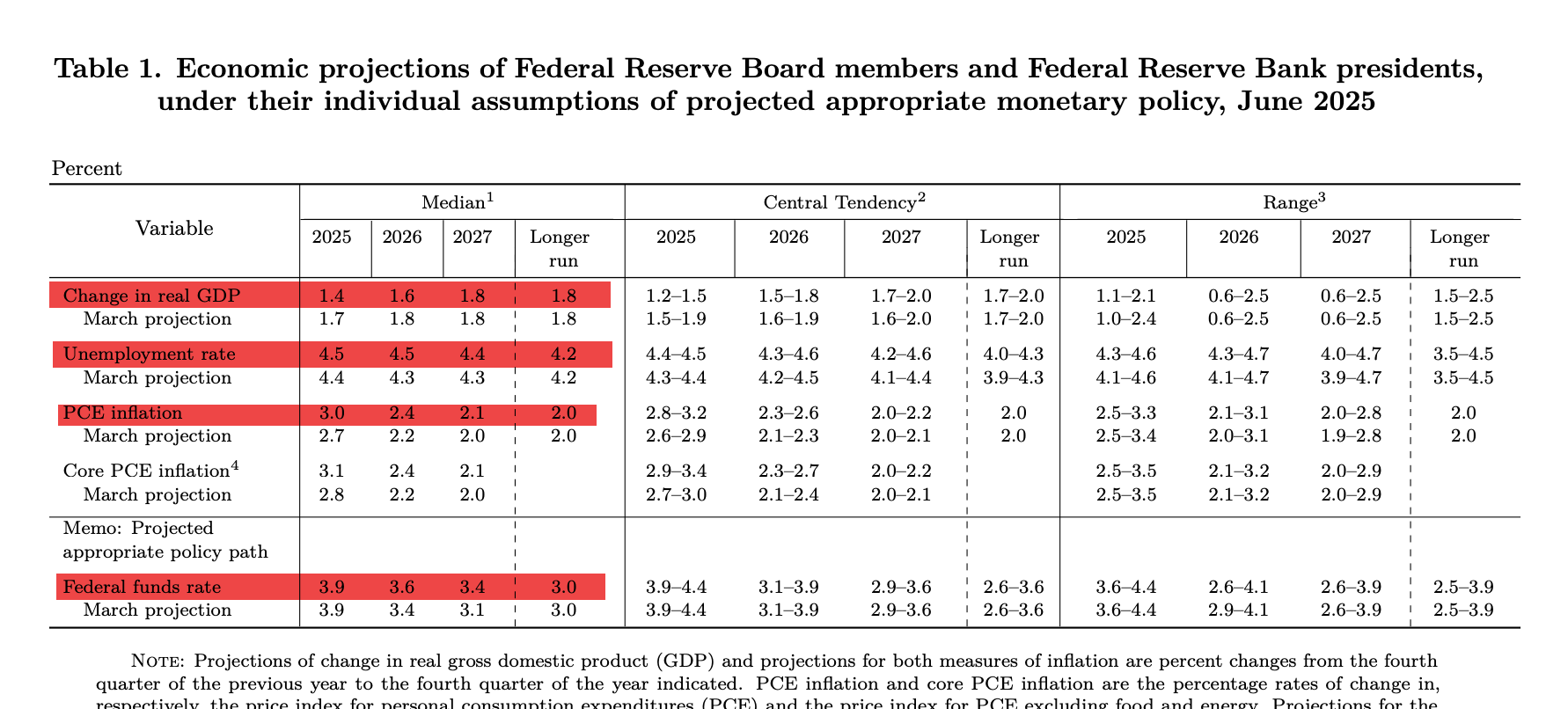

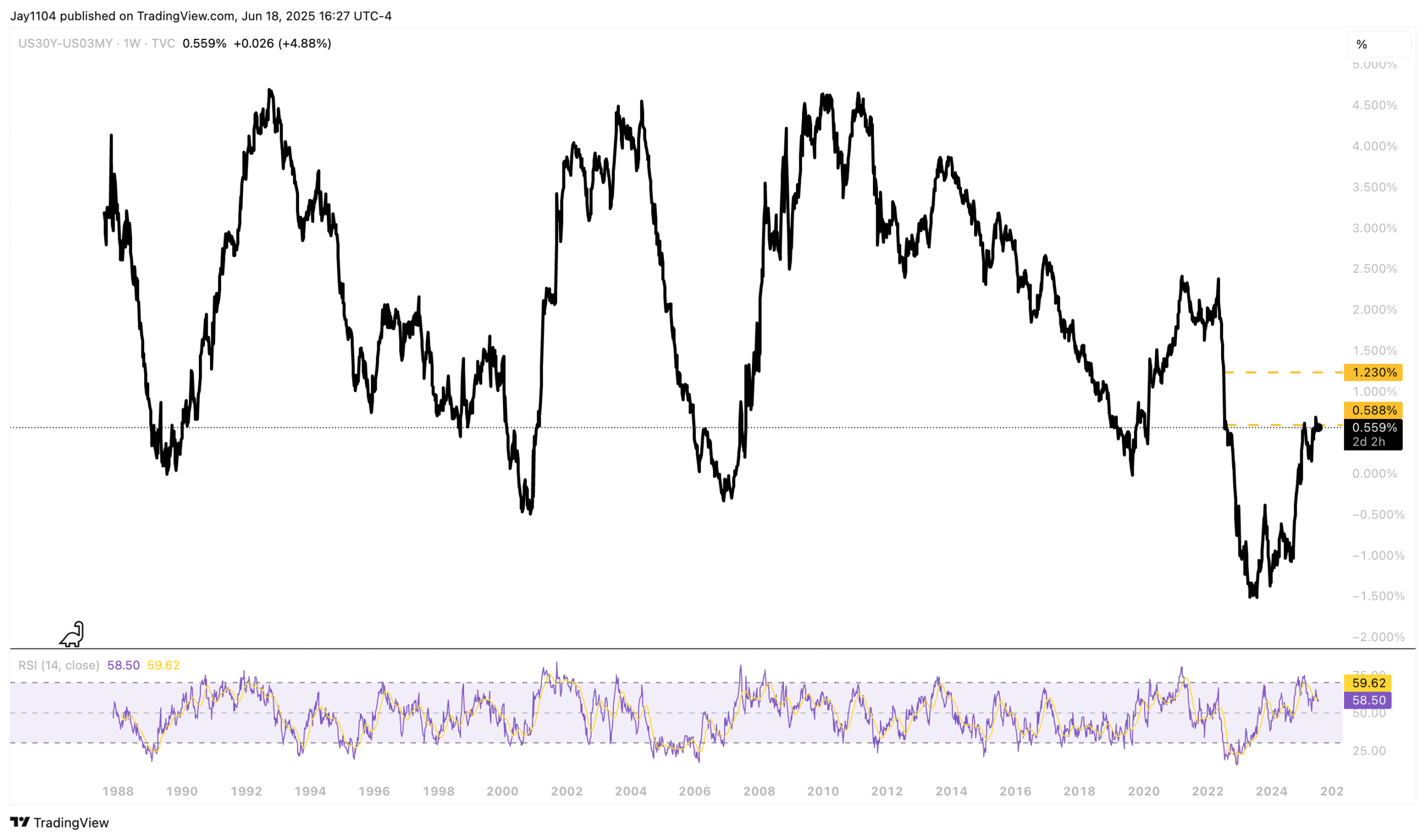

The Fed didn’t announce any headline-grabbing changes. Still, beneath the surface, they downgraded their growth forecast, raised expectations for and in 2025, and reduced anticipated rate cuts for 2026 and 2027. More critically, considering forecasts from both the market and the Fed, it seems increasingly clear—barring an economic crisis—that the era of 0% interest rates has ended, pointing toward structurally higher rates on the long end of the yield curve.

The ended the day essentially unchanged, but notably, it moved from around 4.86-4.87% before the Fed announcement to close at approximately 4.89-4.90%. Given the Fed’s projection of a 3% long-term overnight rate, it’s puzzling why the 30-year rate trades just 55 basis points above the bill. This narrow spread seems unusual and implies that long-term yields likely need to move significantly higher.

I’m not entirely sure of the accuracy of this move, as it seems quite unusual, and it could potentially reverse by Friday. Nonetheless, it’s worth noting that we saw a significant jump in 1-year and 2-year inflation swap rates, with the 1-year spiking to 3.55% and the 2-year rising sharply to 3.19%. Interestingly, this increase didn’t extend to the 5-year inflation swap. I’m uncertain if the market is anticipating a sudden spike in or something else entirely, but it certainly stands out as unusual.

Oil didn’t see significant movement, but if the U.S. becomes actively involved in the Middle East conflict, we could see a sharp spike in oil prices, which would drive inflation expectations higher. Additionally, upcoming announcements regarding tariff rates could also push inflation expectations upward. Therefore, either the inflation swap data is anomalous, or the market may be anticipating news that isn’t yet known.